Content

This usually happens when the company has already provided the goods and services to its client but has not yet invoiced it. Accounting reporting principles state that unearned revenue is a liability for a company that has received payment but which has not yet completed work or delivered goods. The rationale behind this is that despite the company receiving payment from a customer, it still owes the delivery of a product or service. If the company fails to deliver the promised product or service or a customer cancels the order, the company will owe the money paid by the customer. Unearned revenue is a liability since it refers to an amount the business owes customers—prepaid for undelivered products or services.

- Such costs generally represent set-up costs, which include any direct cost incurred at inception of a contract which enables the fulfillment of the performance obligation and totaled $ million at March 31, 2018.

- Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov.

- This method differs from the cash basis method which records revenues and expenses only when monies are exchanged.

- Depreciation Expense and Accumulated Depreciation are driven by information contained in the Capital Asset System and is calculated on the 3rd Thursday of each month (except for year-end).

- Learn the fixed cost definition and how to calculate it using the fixed cost formula.

- This allows the entity to reflect the amount of revenue or expense incurred in the proper fiscal period and allows the matching of income with expenses.

Under the liability method, you initially enter unearned revenue in your books as a cash account debit and an unearned revenue account credit. The debit and credit are of the same amount, the standard in double-entry bookkeeping. The first journal entry reflects that the business has received the cash it has earned on credit. The income statement, also called a profit and loss statement, shows a picture of a company’s performance over time. Company owners, employees and investors use income statements to analyze and asses the company’s past and future performance.

Example #1 Of Unearned Income

It also goes by other names, like deferred income, unearned income, or deferred revenue. Thanks to the recent adoption of Accounting Standards ASC 606, revenue recognition rules are now more uniform (where they used to be industry-specific). Additionally, the Board decided to permit both public and nonpublic organizations to adopt the new revenue standard early, but not before the original public organization effective date . A public organization should apply the new revenue standard to all interim reporting periods within the year of adoption. A nonpublic organization is not required to apply the new revenue standard in interim periods within the year of adoption. Year-End Accounts Payable Accrual – During the AP Accrual batch job, BUY.IU identifies the invoice transactions posted to the general ledger in July that had an invoice date on June 30 or prior.

NetApp Reports Second Quarter of Fiscal Year 2022 Results – Business Wire

NetApp Reports Second Quarter of Fiscal Year 2022 Results.

Posted: Tue, 30 Nov 2021 21:01:00 GMT [source]

The SEC staff has issued comments to registrants asking them to include additional information in their disclosures about the costs they incurred to obtain a contract. The SEC staff has issued comments to registrants asking them to clarify how they determined the categories in which to present disaggregated revenue information. In addition, we are aware that the SEC staff may look to earnings calls and investor presentations when evaluating a registrant’s chosen categories of disaggregation.

Module 4: Financial Statements Of Business Organizations

It’s always great to be paid in advance for goods and services yet to be delivered. However, until those products or services have been provided to your customers, any money received in advance is considered unearned revenue. No journal entry is made by the landlord at the end of each day to record the earning of $20 in rent revenue that day. But the landlord does make an adjustment at the end of the year, on December 31, when the accounting records are going to be used to prepare financial statements. The landlord now has an obligation to provide rental services for the next 12 months. We call this obligation “Unearned Rent Revenue” which is reported on the balance sheet as a liability. One type of adjusting entry records the gradual use of a prepaid expense such as rent or insurance.

- At the end of the second quarter of 2020, Morningstar had $287 million in unearned revenue, up from $250 million from the prior-year end.

- This usually happens when the company has already provided the goods and services to its client but has not yet invoiced it.

- Although we observed some consistency in their disclosures, companies’ interpretations of the requirements and the amount of information to disclose have varied.

- Companies are turning to smarter, AI-oriented solutions for recognizing and reporting revenue, such as ProfitWell Recognized.

- We also analyzed how many different disaggregation categories each of the entities considered relevant.

Disclosure Examples 19 through 21 below illustrate how entities have disclosed management’s election of practical expedients under the new revenue standard. Most entities in our sample used more than one practical expedient . The most common practical expedients used were those related to disclosures about remaining performance obligations. Entities are generally required to disclose and explain the practical expedients they used under the new revenue guidance. Although the standard does not dictate where they should present these disclosures, entities in our sample typically included them in their “Significant Accounting Policies” disclosure or in the revenue footnote. Costs to fulfill a contract are capitalized when they relate directly to an existing contract or specific anticipated contract, generate or enhance resources that will be used to fulfill performance obligations and are recoverable.

Does Unearned Revenue Affect Working Capital?

Once the product or service is delivered, unearned revenue becomes revenue on the income statement. It is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer.

Revenue recognition is a generally accepted accounting principle that dictates how revenue is accounted for. According to GAAP, unearned revenue is recognized over time as the product or service is delivered, based on certain critical events. Unearned revenue is the revenue a business has received for a product or service that the business has yet to provide unearned revenue is reported in the financial statements as: to the customer. Any business that takes upfront or prepayments before delivering products and services to customers has unearned revenue, which is often also called deferred revenue. Like deferred revenues, deferred expenses are not reported on the income statement. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred.

General Accounting

Unearned sales are most significant in the January quarter, where most of the large enterprise accounts buy their subscription services. Similarly, for example, a company signs a multi-period contract. One of its terms is to record revenue only when the contract period ends. Why then does your pre-paid membership create a liability for the company? If the gym burned down in May and you could no longer go to the gym, the company would be “liable” to you for the remaining 7 months of membership dues that you paid for but did not get to use. That’s considered unearned revenue, and there’s a special way to record it. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.

What is unearned service income?

Unearned Service Revenue is a liability account that is used to record advanced collections from clients of a service type business. In other words, it pertains to revenue already collected but the service has not yet been rendered.

From a big-picture perspective, we observed that in many instances, the revenue disclosures were at least three times as long as the prior-year disclosures. When combined with the $7,200 in Unearned Rent Revenue initially recorded on April 1, this $5,400 reduction means that the adjusted Unearned Rent Revenue liability is now recorded at $1,800 on the landlord’s books. So here is the completed adjusting entry to be made on December 31. Breaking up their project payments into smaller installments can actually be a big help. By charging a deposit upfront, you’ll keep your cash flow positive, allowing you to stay afloat.

When Will The Final Accounting Standards Update Be Effective?

Contract liabilities represent payments received in advance of providing services under certain contracts and were $ million at Jan. 1, 2018 and $ million at March 31, 2018. Contract liabilities are included in other liabilities on the consolidated balance sheet. Revenue recognized in the first quarter of 2018 relating to contract liabilities as of Jan. 1, 2018 was $ million. Must all be considered annually, those related to disaggregated revenue, contract balances, and remaining performance obligations are also required in interim financial statements prepared under U.S. Assets, liabilities, capital stock, and retained earnings all start out each year with a balance that is the same as the ending figure reported on the previous balance sheet. Those accounts are not designed to report an impact occurring just during the current year. In contrast, revenues, expenses, gains, losses, and dividends paid all begin the first day of each year with a zero balance—ready to record the events of this new period.

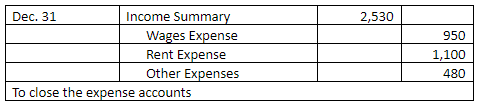

In the same manner as journal entries and adjusting entries, closing entries are recorded initially in the company’s journal and then posted to the ledger. As a result, the beginning retained earnings balance for the year is updated to arrive at the ending total reported on the balance sheet.

Setting Up The Balance Sheet Forecasts

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

In order for a student account transaction to participate in the accrual process, two conditions must be met. First, the item type must belong to an item type group defined for this purpose. Second, the revenue or expense account must have an IU fund type of GF, DS or RF.

Free Accounting Courses

ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. We’ve compiled a list of terms we think business owners should know.

FMC reports 85% net position increase Local/State Headlines – The Franklin Sun

FMC reports 85% net position increase Local/State Headlines.

Posted: Wed, 01 Dec 2021 12:00:00 GMT [source]

Such costs generally represent set-up costs, which include any direct cost incurred at inception of a contract which enables the fulfillment of the performance obligation and totaled $ million at March 31, 2018. These capitalized costs are amortized on a straight line basis over the expected contract period which generally range from seven to nine years. The amortization is included in other expense and totaled $ million in the first quarter of 2018.

What is accounting entry of unearned revenue?

Unearned revenue is a liability for the recipient of the payment, so the initial entry is a debit to the cash account and a credit to the unearned revenue account. … The unearned revenue account is usually classified as a current liability on the balance sheet.

On August 12, 2015, the FASB issued an Accounting Standards Update deferring the effective date of the new revenue recognition standard by one year. Members of the TRG included financial statement preparers, auditors, and users representing a wide spectrum of industries, geographical locations and public and private companies and organizations. Simplifies the preparation of financial statements by reducing the number of requirements to which an organization must refer. Record any accrual adjusting entry over the IU specified threshold; refer to the Fiscal Year-End Closing Checklist for threshold values.

Depreciation – The principle of historical cost requires that capital assets are recorded at their original cost. However, as time goes by, the capital assets are not typically worth their original amount. In order to reflect this on IU’s financial statements, capital assets are depreciated over their useful life. Depreciation Expense and Accumulated Depreciation are driven by information contained in the Capital Asset System and is calculated on the 3rd Thursday of each month (except for year-end). For more information, please refer to the Accounting for Assets Section. Relates to supplies that are purchased and stored in advance of actually needing them.

Author: Barbara Weltman